Allowance for Doubtful Debt Double Entry

An allowance for doubtful accounts is considered a contra asset because it reduces the amount of an asset in this case the accounts receivable. The allowance for irrecoverable debts is to be provided for a specific debt of 200 plus 2 of the remaining trade receivables.

Allowance For Doubtful Accounts Double Entry Bookkeeping

The journal entry for creating this allowance for doubtful debt is as follows.

. An irrecoverable debt is a debt which is or is considered to be uncollectable. The amount owed by the customer of 2000 has been removed from accounts receivable by the credit entry as it is no longer recoverable. The double entry required to achieve.

In this case we can determine the allowance for doubtful accounts with the calculation as below. In fact there are 2 approaches for doing so. Heres how it works.

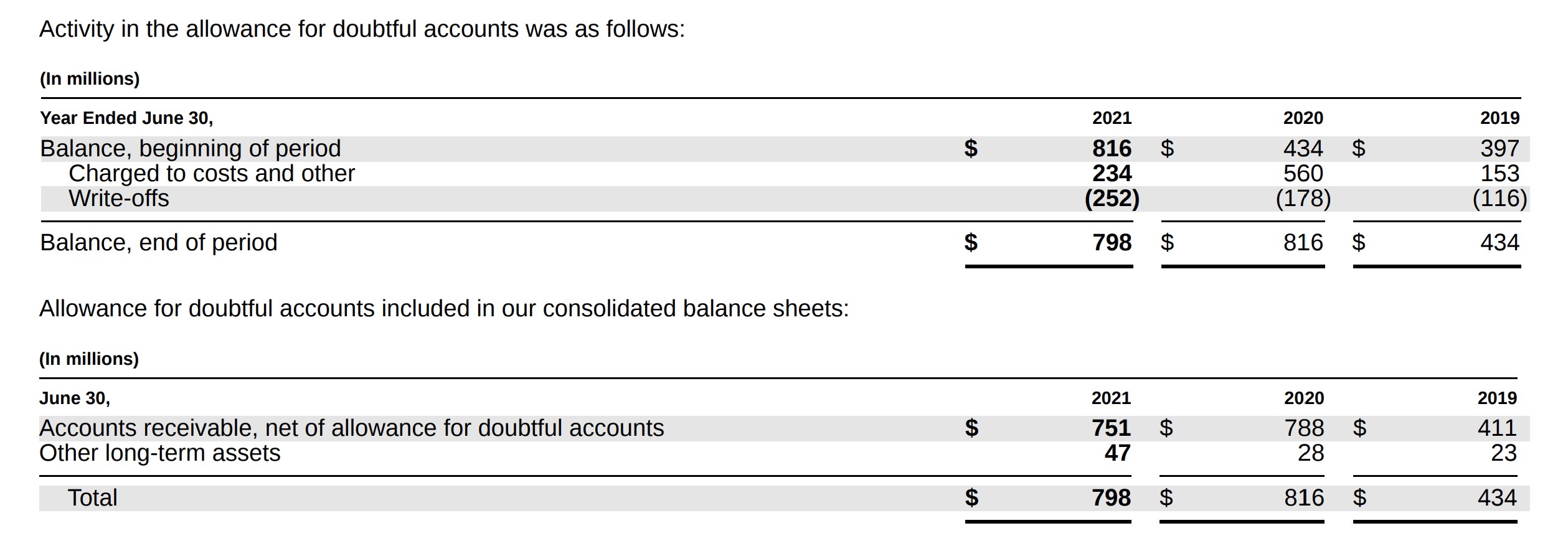

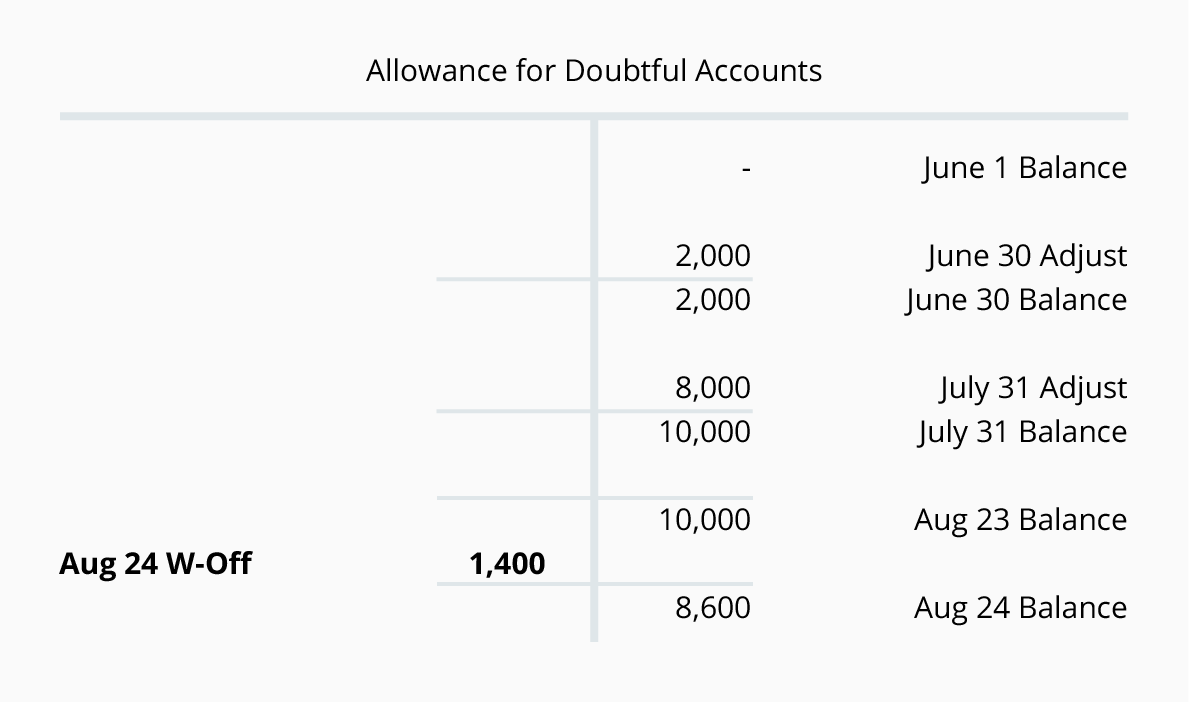

The debit entry records the bad debt write off to the allowance for doubtful accounts. Accounts receivable 10000. Allowance For Doubtful Accounts.

To predict your companys bad debts create an allowance for doubtful accounts entry. Allowance Method For Bad Debt Bookkeeping Entries Explained. As a general allowance of 1500 has already been created only 500 additional allowance must be charged to the income statement.

Allowance for doubtful accounts balance Accounts receivable at the end of the accounting period x Estimated uncollectible Allowance for doubtful accounts balance 150000 x 5 Allowance for doubtful accounts balance 7500. The entry does not impact earnings in the current period. Allowance for doubtful accounts on the Balance Sheet.

However there already exists a provision of 9200 which is brought forward from 2016. A business had previously written off a bad debt of 2000 using the allowance method for bad debts but has now managed to make a bad debt recovery and has received 900 in part payment of the account. In this case the required allowance is 2000000.

To calculate the allowance for doubtful accounts. General allowance for irrecoverable debts 2100 5 200 104. Credit sales all come with some degree of risk that the customer might not hold up their end of the transaction ie.

Provision for Doubtful debt xxx. The allowance is a credit balance which is then set against the carrying amount of the receivables in the statement of financial position. Bad debt Expense 50000 X 52500800 3300.

Using the percentage of sales method they estimated that 1 of their credit sales would be uncollectible. Allowance for doubtful is the contra asset account with accounts receivable which present in the balance sheet. But this method can be a broad estimation.

At the end of 2017 provisions for bad debts should be 2 of 432000 8640. Increase in allowance for irrecoverable debts Specific Allowance. 39550 5000 34550 adjusting entry.

An allowance for doubtful accounts is recorded in the bookkeeping records as follows. A general allowance of 2000 50000-10000 x 5 must be made. Allowance for Doubtful Debts Expense 500.

The double entry for recording provision for doubtful debt is. 200000 x 25 5000 allowance required. Your allowance for doubtful accounts estimation for the two aging periods would be 550 300 250.

On March 31 2017 Corporate Finance Institute reported net credit sales of 1000000. When it comes to bad debt and ADA there are a few scenarios you may need to record in your books. 5000 x 1 25000 x 20 6000 x 35 54000 x 60 39550.

If we assume that the allowance for uncollectible accounts showed a credit balance of 5000 before adjustment we will make the following adjusting entry. Allowance for doubtful accounts journal entry. Show the relevant entries.

An allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the accounts receivable expected to be. The allowance sometimes called a bad debt reserve represents managements estimate of the amount of accounts receivable that will not be paid by customers. The original sale remains in the accounts as this did actually take place.

Allowance for Doubtful Debts Balance Sheet 500. The allowance for doubtful accounts or the bad debt reserve appears on the balance sheet to anticipate credit sales where the customer cannot fulfill their payment obligations. To become more accurate about how many provisions we.

The original invoice would have been posted to the accounts receivable control account so the balance on the customers account before the allowance for doubtful accounts is 5000. Doubtful Debts PL expense ac xxx. Allowance for doubtful Debt 3300.

With both methods the bad debt expense needs to record in the income statement by a different time. As the business uses the allowance method the journal entry to record the bad debt recovery is done in two steps as follows. From this amount the company can calculate the allowance for bad debts which will be 9000 90000 x 10.

As you can see 10000 1000000 001 is determined to be the bad debt expense that management estimates to incur. If actual experience differs then management adjusts its estimation. This allowance will be 25 of the total trade receivables balance after any irrecoverable debts are taken off.

If the total credit sales is of 100000 then the allowance for doubtful debts would be as per Pareto principle 100000 20 20000. After this double entry the remaining balance in accounts receivable will be 90000 100000 10000. Heres an example.

When cash payments left unmet. In general approach there are 3 stages of a financial asset and you should recognize the impairment loss depending on the stage of a financial asset in question. However David still wants to maintain a provision for bad debts at 2 of debtors.

Once it is certain that the debt has gone bad debt. If the allowance has a current balance of 1 million you will need to make the following journal entry. The accounting records will show the.

With such debts it is prudent to remove them from the accounts and to charge the amount as an expense for irrecoverable debts to the income statement. Provision for doubtful accounts. Hence the allowance for doubtful accounts increase by 390 890 500 during the accounting period.

Accordingly the company credits the accounts receivable account by 40000 to reduce the amount of outstanding accounts receivable and debits the Allowance for Doubtful Accounts by 40000. Accounting for doubtful debts basic double entry Note that the allowance account might also be called the provision for doubtful debts account. Allowance for doubtful accounts on December 31 1500 x 3 800 x 10 1200 x 20 1050 x 50 890.

IFRS 9 requires you to recognize the impairment of financial assets in the amount of expected credit loss. This entry reduces the balance in the allowance account to 60000. It has been decided that an allowance for doubtful debt is to be created.

The double entry for it will be as follows. Most people may confuse this account as the liability but it is not even it is a negative asset account. So the accounting entry for this year would be as follows assuming there is no opening balance for allowance for doubtful debt accounts carried forward from previous years.

Therefore this should be reduced by 560 9200 8640. Journal Entry for the Allowance for Doubtful Accounts.

Allowance Method For Bad Debt Double Entry Bookkeeping

Bad Debt Recovery Financiopedia

Allowance For Doubtful Accounts Debit Credit Journal Entry

Writing Off An Account Under The Allowance Method Accountingcoach

No comments for "Allowance for Doubtful Debt Double Entry"

Post a Comment